Code Context <div class="modal-body text-center">

<video controls autoplay muted style="max-width: 100%; height: auto;">

<source src="<?php echo $videos;?>" type="video/mp4">

$___viewFn = "/home/stafir/htdocs/stafir.com/app/View/Elements/users/services/services-detail.ctp"

$___dataForView = array(

"_user" => User

User::$name = "User"

User::$belongsTo = array

User::$useDbConfig = "default"

User::$useTable = "users"

User::$id = false

User::$data = array

User::$table = "users"

User::$primaryKey = "id"

User::$validate = array

User::$validationErrors = array

User::$validationDomain = NULL

User::$tablePrefix = "tbl_"

User::$alias = "User"

User::$tableToModel = array

User::$cacheQueries = false

User::$hasOne = array

User::$hasMany = array

User::$hasAndBelongsToMany = array

User::$actsAs = NULL

User::$Behaviors = BehaviorCollection object

User::$whitelist = array

User::$cacheSources = true

User::$findQueryType = NULL

User::$recursive = 1

User::$order = NULL

User::$virtualFields = array

User::$__backAssociation = array

User::$__backInnerAssociation = array

User::$__backOriginalAssociation = array

User::$__backContainableAssociation = array

User::$findMethods = array

User::$Country = Country object

User::$State = State object

User::$City = City object

User::$Industry = Industry object

User::$IndustrySubCategory = Industry object,

"service" => array(

"Service" => array(),

"User" => array(),

"Category" => array(),

"SubCategory" => array(),

"ServiceImage" => array()

),

"userid" => null,

"relatedServices" => array(

array()

),

"title_for_layout" => "CFO Services :: Stafir"

)

$_user = User

User::$name = "User"

User::$belongsTo = array

User::$useDbConfig = "default"

User::$useTable = "users"

User::$id = false

User::$data = array

User::$table = "users"

User::$primaryKey = "id"

User::$validate = array

User::$validationErrors = array

User::$validationDomain = NULL

User::$tablePrefix = "tbl_"

User::$alias = "User"

User::$tableToModel = array

User::$cacheQueries = false

User::$hasOne = array

User::$hasMany = array

User::$hasAndBelongsToMany = array

User::$actsAs = NULL

User::$Behaviors = BehaviorCollection object

User::$whitelist = array

User::$cacheSources = true

User::$findQueryType = NULL

User::$recursive = 1

User::$order = NULL

User::$virtualFields = array

User::$__backAssociation = array

User::$__backInnerAssociation = array

User::$__backOriginalAssociation = array

User::$__backContainableAssociation = array

User::$findMethods = array

User::$Country = Country object

User::$State = State object

User::$City = City object

User::$Industry = Industry object

User::$IndustrySubCategory = Industry object

$service = array(

"Service" => array(

"id" => "46",

"user_id" => "639",

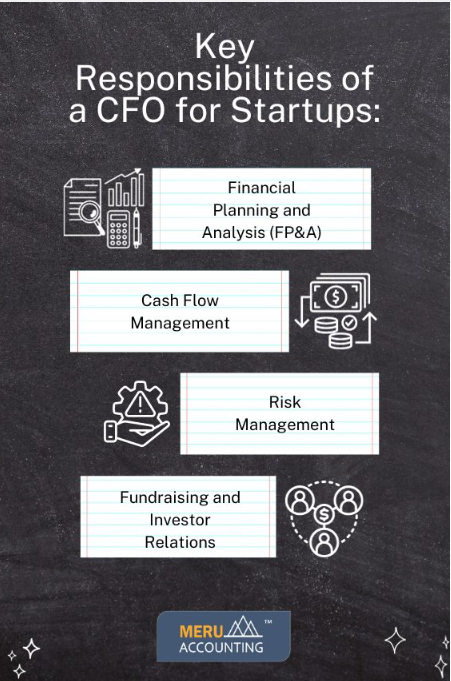

"name" => "CFO Services",

"category_id" => "1123",

"subcategory_id" => "1341",

"price" => "1.00",

"unit_type" => "0",

"unit_of_measure" => "",

"unit_value" => "",

"delivery_cost" => "1.00",

"minimum_orders" => "1",

"completed_orders" => null,