Search Service

- Services

- Categories

- Finance

- Financial and credit consulting

Bookkeeping Services by Meru Accounting: Your Partner in Financial Clarity

At Meru Accounting, we believe that every successful business begins with a strong financial foundation. Our comprehensive bookkeeping services are designed to give you accurate, real-time insights into your company’s financial health, so you can focus on what matters most—growing your business.

Whether you're a startup navigating your first year or an established company looking for a streamlined approach, our bookkeeping solutions are tailored to your unique needs. We handle the details, so you don’t have to worry about managing receipts, tracking expenses, or keeping up with the latest accounting regulations. With Meru Accounting, you gain a reliable financial partner that ensures every transaction is recorded meticulously and every report is generated with precision.

What We Offer:

- Accurate Recordkeeping: We capture every transaction, from invoices to payments, ensuring your books are always up-to-date and compliant with accounting standards.

- Customized Reports: Receive detailed, easy-to-understand financial reports that help you monitor cash flow, profits, and financial trends.

- Tax Readiness: Our bookkeeping services prepare your records for tax season, reducing the stress of last-minute preparations and helping you minimize tax liabilities.

- Timely Financial Insights: We provide monthly or quarterly financial statements so you can make informed business decisions backed by data.

- Scalable Solutions: As your business grows, we adapt our services to meet your evolving needs, whether you need more advanced reporting or specialized advice.

At Meru Accounting, we take the time to understand your business, your industry, and your specific goals. Our approach to bookkeeping isn’t just about balancing books—it’s about building a clear, strategic financial picture that enables you to make smarter decisions with confidence.

Let us handle the numbers, so you can focus on building the future of your business. Reach out today to discover how our bookkeeping services can bring clarity and efficiency to your financial management.

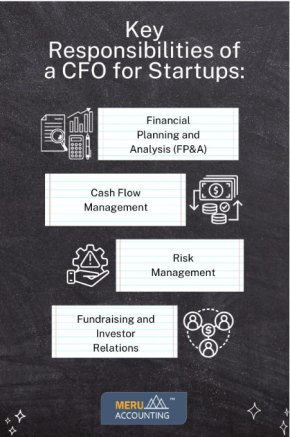

CFO Services by Meru Accounting: Strategic Financial Leadership for Your Business

As your business grows, the complexity of financial management also increases. Having a strategic financial leader on your team is essential to guide your business through key decisions, improve profitability, and ensure long-term sustainability. Meru Accounting’s CFO (Chief Financial Officer) services provide you with expert financial leadership without the overhead of hiring a full-time executive.

Our experienced CFOs act as trusted advisors, offering high-level financial strategy, oversight, and analysis to help your business thrive in today’s competitive landscape. Whether you are a startup, a small business, or a growing enterprise, we provide the tools, insights, and expertise to drive your financial success.

Why Choose Meru Accounting for CFO Services?

-

Strategic Financial Leadership: Our CFOs bring years of expertise and a strategic mindset to help you make smarter financial decisions. From financial forecasting to capital allocation, we guide your business through critical growth phases, offering a clear vision for the future while managing risks.

-

Financial Planning & Forecasting: We help you create and implement a detailed financial plan that aligns with your business goals. By developing accurate financial forecasts and projections, we help you anticipate future trends, optimize resources, and prepare for potential challenges—ensuring that your business stays on track for sustainable growth.

-

Cash Flow Management: Cash flow is the lifeblood of any business. We provide you with a comprehensive strategy for managing cash flow, optimizing working capital, and ensuring you have the liquidity necessary to invest in growth opportunities, pay your team, and cover operational expenses.

-

Profitability & Cost Optimization: A strong CFO doesn’t just focus on revenue growth, but also on improving profitability. We conduct detailed analyses of your profit margins, identify cost inefficiencies, and implement strategies to increase profitability without sacrificing quality or customer satisfaction.

-

Financial Reporting & Analysis: We go beyond basic accounting to provide you with actionable insights into your business’s financial health. With in-depth financial reports and key performance indicators (KPIs), we give you the clarity you need to make data-driven decisions and identify opportunities for improvement.

-

Budgeting & Expense Management: Our CFO services include the creation of detailed budgets that align with your growth objectives, helping you monitor and control expenses more effectively. We implement a system for tracking your financial performance against budgeted targets, ensuring that your business remains efficient and on course.

-

Risk Management & Compliance: As your financial guardian, we ensure that your business is compliant with all regulatory requirements and industry standards. Our CFOs identify potential risks—whether financial, operational, or market-related—and provide actionable strategies to mitigate them. We help you navigate complex tax regulations, industry laws, and corporate governance requirements to keep your business protected.

-

Mergers & Acquisitions (M&A) Advisory: If your business is considering a merger, acquisition, or partnership, our CFO services provide the financial expertise needed to evaluate these opportunities. We guide you through the due diligence process, assess potential risks, and ensure that the transaction aligns with your long-term strategic goals.

-

Fundraising & Investor Relations: Whether you’re seeking capital from investors, venture capitalists, or lenders, we help you position your business to attract funding. Our CFOs assist with preparing financial statements, creating business plans, and presenting your case to investors, helping you secure the financing needed to fuel growth.

Benefits of CFO Services with Meru Accounting:

- Enhanced Financial Strategy: Our CFOs bring strategic insight into all aspects of your business’s finances, ensuring that every decision you make is backed by solid financial data and long-term vision.

- Cost Savings & Efficiency: We help you optimize operations, reduce waste, and focus on the most profitable areas of your business, ultimately leading to better financial performance.

- Scalable Solutions: Whether you’re a startup or an established business, our CFO services can scale with your company, providing the financial leadership you need at every stage of growth.

- Improved Decision-Making: With detailed financial analysis, forecasting, and KPIs, we empower you to make informed, data-driven decisions that positively impact your bottom line.

- Peace of Mind: Let us handle the complex financial aspects of your business while you focus on growth. With Meru Accounting’s CFO services, you’ll have confidence knowing that your finances are in capable hands.

What You Can Expect:

- Dedicated CFO Expertise: Work directly with a seasoned CFO who understands your business and is dedicated to helping you achieve your financial goals.

- Customized Solutions: Every business is unique. Our CFO services are tailored to your company’s needs, ensuring the financial strategy aligns with your vision and goals.

- Regular Financial Reviews: We offer ongoing reviews of your financial performance to ensure everything is on track and recommend adjustments when necessary.

- Comprehensive Financial Oversight: Our CFOs manage and oversee all aspects of your financial operations, from budgeting to tax planning, so that you can focus on running your business.

At Meru Accounting, we provide the expertise and strategic insight of a full-time CFO at a fraction of the cost. Our goal is to help you build a strong financial foundation that supports your business’s growth and long-term success.

Unlock the power of financial leadership with Meru Accounting’s CFO services. Contact us today to learn how we can help guide your business toward a prosperous future.

Breast Augmentation Financing by eFinancing Solutions LLC

At eFinancing Solutions LLC, we understand that making the decision to undergo breast augmentation is a significant one, and we’re here to make the financial aspect easier for you. Our Breast Augmentation Financing services are designed to offer flexible, affordable payment plans that allow you to achieve the look you’ve always desired without the stress of upfront payments. Whether you're considering enhancement for cosmetic reasons or medical purposes, we provide the financing options that give you the freedom to make this life-changing procedure more accessible.

With eFinancing Solutions LLC, you’ll receive personalized, transparent, and fast financing solutions, making the process simple and straightforward. Our goal is to help you focus on your journey to confidence and satisfaction while we handle the financial side of things.

Key Features of Our Breast Augmentation Financing:

- Flexible Payment Plans: Choose from a variety of financing options that best fit your budget, with terms designed to make payments manageable and affordable over time.

- Quick and Easy Application: Applying for financing is simple and fast. Our online application process is streamlined, allowing you to get approved within minutes and move forward with your procedure as soon as possible.

- Competitive Interest Rates: Benefit from competitive interest rates and low monthly payments, ensuring you can comfortably finance your breast augmentation without compromising your financial stability.

- No Hidden Fees: At eFinancing Solutions LLC, we believe in transparency. Our financing plans come with no hidden fees or surprises, so you’ll always know exactly what to expect.

- Supportive Customer Service: Our dedicated customer service team is here to guide you through the financing process, answer your questions, and help you find the best options to suit your needs.

- Accessible to All: Whether you have good credit, bad credit, or no credit history at all, we offer financing options that can work for a variety of financial situations, making breast augmentation accessible to more individuals.

- Instant Pre-Approval: Get pre-approved in minutes, so you can move forward with your procedure without unnecessary delays. Our pre-approval process makes it easier to plan ahead and ensure you're ready for the next steps.

At eFinancing Solutions, we champion your aspirations for aesthetic perfection. Breast augmentation is no longer a distant dream but an accessible reality, thanks to our tailored financing solutions. Designed for every credit score, we bridge you to a vast network of lenders, ensuring your path to beauty is both affordable and attainable.

Why eFinancing Solutions Stands Out for Breast Augmentation Financing

Bespoke Financing Options: Tailored perfectly to your financial canvas, our plans adapt to your credit score, sketching out a future where your aesthetic desires are realized.Vast Lender Canvas: A broad palette of lending partners ensures your application’s masterpiece finds its matching patron, promising favorable rates and terms.

Swift, Secure, Seamless: Our technology is the brush that paints a quick, secure path to approval, safeguarding your personal details with each stroke.

Clarity in Communication: Like a gallery tour, we guide you through your financing journey, ensuring every detail is clear and every question answered.

Bariatric Weight Loss Surgery Financing by eFinancing Solutions LLC

At eFinancing Solutions LLC, we understand that deciding to undergo bariatric weight loss surgery is a transformative and personal journey. Our goal is to make this life-changing procedure more accessible by offering flexible financing options tailored to fit your unique needs and financial situation. Whether you're seeking to improve your health, boost your confidence, or manage chronic conditions related to obesity, our Bariatric Weight Loss Surgery Financing provides a solution that helps you move forward with peace of mind.

With our simple and transparent process, you can focus on achieving your health goals while we help you manage the financial aspects. Our easy-to-understand payment plans give you the flexibility to choose the right option for your budget, making bariatric surgery a reality for more people.

Key Features of Our Bariatric Weight Loss Surgery Financing:

- Flexible Payment Options: We offer a range of financing plans to fit your budget. Choose terms that work best for you, with low monthly payments designed to make your bariatric surgery affordable without compromising your finances.

- Quick and Simple Application: The application process is quick and straightforward, ensuring that you receive approval in a timely manner so you can focus on preparing for your surgery.

- Competitive Interest Rates: We provide financing options with competitive interest rates, helping to keep your monthly payments manageable and affordable throughout the term of your loan.

- No Hidden Fees: At eFinancing Solutions LLC, we believe in full transparency. Our financing terms come with no hidden fees, allowing you to plan ahead and avoid any unexpected financial surprises.

- Inclusive Financing: We work with individuals in all credit situations. Whether you have good credit, poor credit, or are just starting to build your credit, we offer financing solutions that accommodate a variety of financial profiles.

- Personalized Customer Support: Our dedicated team is here to assist you throughout the financing process. From answering your questions to helping you select the best option for your needs, we provide support every step of the way.

- Instant Pre-Approval: Get pre-approved for financing within minutes, allowing you to confidently move forward with your surgery planning and ensuring no delays in starting your weight loss journey.

At eFinancial Solutions, we understand that embarking on a weight loss journey, especially when considering surgical options, is a significant step towards a healthier life. Weight loss surgery, also known as bariatric or metabolic surgery, is a proven medical approach for those who have struggled with obesity and related health issues. This surgery isn’t just about losing weight; it’s a transformative procedure that modifies your digestive system to help you achieve and maintain long-term weight loss.

eMerchant Loan Agency Financing Solutions

Have you ever thought about how many clients and projects you lose each year to budget constraints and pricing? Isn’t it time you offered your clients more than just home improvement services? Imagine if every quote you provided came with an affordable financing option that fits perfectly within your client’s budget. Welcome to eFinancing Solutions, where we empower contractors like you to not only dream bigger but also achieve those dreams with our state-of-the-art fintech solutions.

At eMerchant Loan Agency, we specialize in providing tailored financing solutions to help businesses thrive and grow. Whether you're a small startup or an established company, our loan services are designed to meet your unique needs and provide you with the financial flexibility you require to succeed. From working capital to equipment financing or expansion funding, our goal is to support your business at every stage of its journey.

Our simplified application process, competitive interest rates, and fast approval times ensure that you can access the funds you need when you need them. With eMerchant Loan Agency, you can focus on growing your business while we handle the financial details.

Key Features of eMerchant Loan Agency Financing Solutions:

- Flexible Loan Options: We offer a variety of loan products tailored to your business’s specific needs, including working capital loans, merchant cash advances, equipment financing, and more. Choose the option that best aligns with your goals.

- Fast and Easy Application Process: Our online application process is quick and user-friendly. You can apply in just a few minutes and receive a decision in no time, allowing you to access the funds when you need them most.

- Competitive Interest Rates: At eMerchant Loan Agency, we understand that cost matters. That’s why we offer competitive interest rates to ensure that you can manage your loan repayment without straining your business’s finances.

- No Hidden Fees: Transparency is at the core of what we do. There are no hidden fees or surprise costs with our financing options, so you can budget effectively and have full visibility into your loan terms.

- Access to Working Capital: Whether you need cash for inventory, marketing, payroll, or expansion, our loans are designed to provide your business with the necessary capital to seize new opportunities and stay competitive in your industry.

- Quick Approval and Disbursement: We know time is money, which is why we offer fast approvals and quick disbursement of funds. This ensures that your business doesn’t face unnecessary delays and can continue to move forward.

- Flexible Repayment Plans: We understand that every business has its own cash flow cycle, so we offer flexible repayment terms that align with your revenue, ensuring that loan payments are manageable and won't impact your operations.

Why Choose eMerchant Loan Agency?

At eMerchant Loan Agency, we are committed to helping your business succeed. Whether you need funds for day-to-day operations, major projects, or expansion, our financing solutions are designed to support your growth. With our fast, flexible, and transparent loan options, you can take your business to the next level with confidence.

Apply for financing with eMerchant Loan Agency today, and let us provide you with the capital needed to drive your business forward.

With this card you are always and everywhere protected against misuse of your bank details. The built-in RFID protection ensures the optimal security of all data present on all cards that are also in your wallet.

An exclusive smart product that takes into account the possible dangers from outside, so that you can focus carefree on the things that you really find important in life.

Contact:- shrinkconsulting@gmail.com

At ShrinkConsulting, we help businesses keep their financial records accurate, up-to-date, and compliant. Our team handles both bookkeeping (day-to-day recording) and accounting (financial reporting and analysis) with care and accuracy.

📘 Bookkeeping Services

We take care of all your daily financial entries so you can focus on your business. Our bookkeeping services include:

-

Recording daily business transactions

-

Maintaining general ledger

-

Categorizing income and expenses

-

Bank and credit card reconciliation

-

Managing accounts payable and receivable

-

Recording journal entries

-

Maintaining clean and audit-ready books

Our goal is to give you a clear and organized view of your financials at all times.

📗 Accounting Services

We go beyond bookkeeping to help you understand your business performance and make smart decisions. Our accounting services include:

-

Preparing monthly, quarterly, and yearly financial reports

-

Balance sheet and profit & loss statement preparation

-

Adjustments and closing entries

-

Budgeting and forecasting support

-

Financial analysis and ratio reports

-

Year-end accounting and audit support

-

Compliance with local accounting standards

We turn your numbers into insights to help you grow.

Contact:- shrinkconsulting@gmail.com

Contact:- shrinkconsulting@gmail.com

At ShrinkConsulting, we offer end-to-end financial services to help businesses make better decisions, stay compliant, and grow with confidence. Our financial experts handle everything from budgeting to reporting—giving you peace of mind and accurate insights.

📘 Our Financial Services Include:

-

Financial Statement Preparation

We prepare accurate Profit & Loss statements, Balance Sheets, and Cash Flow statements. -

Budgeting & Forecasting

Helping you plan business expenses and predict future cash flow with clarity. -

Cash Flow Management

Monitoring inflow and outflow of cash to maintain healthy liquidity. -

Financial Analysis & Reporting

Analyzing business performance through financial ratios and custom reports. -

Management Reports

Monthly and quarterly reports to help business owners and stakeholders make decisions. -

KPI Tracking & Dashboards

Tracking financial KPIs and visualizing business health with easy-to-read dashboards. -

Year-End Financials

Preparing final reports for tax filing, audits, or investor presentations. -

Audit Support

Assisting during internal or external audits with accurate records and reconciliations. -

Custom Financial Reports

Creating reports based on your industry needs or specific goals.

Contact:- shrinkconsulting@gmail.com

Capital Closure is a trusted company liquidation service provider based in Dubai. We help businesses close their operations legally, smoothly, and without stress. Our expert team handles voluntary and involuntary liquidations for mainland and free zone companies across the UAE. We manage the full process, including trade license cancellation, VAT deregistration, corporate tax compliance, employee settlements, bank account closure, and government clearances. Our services also cover final audits, liquidation reports, and debt settlement guidance. Our goal is to make company closure simple, clear, and worry-free while protecting your interests and ensuring full legal compliance.

Official Website: https://capitalclosure.ae/